Quantum Computing ETF: Investing in the Future of Innovation

Quantum computing ETF is fast becoming one of the most talked-about investment trends in the modern tech-driven economy. As quantum computing continues to evolve, many investors are looking for ways to get exposure to this next-gen technology without needing to bet on a single company. Enter the quantum computing ETF a diversified, relatively lower-risk way to ride the wave of innovation.

While the quantum computing sector is still in its early stages, the technology has enormous potential. It’s set to revolutionize industries like pharmaceuticals, cybersecurity, finance, and even space exploration. That said, figuring out how to invest in such a futuristic space can be daunting. That’s where the quantum computing ETF comes into play, offering a curated basket of companies involved in developing or utilizing quantum tech. In this guide, we’ll break down what a quantum computing ETF is, how it works, what to watch for, and why it’s catching the eye of savvy investors around the world.

Understanding What a Quantum Computing ETF Is

A quantum computing ETF is essentially a financial product that bundles together stocks of multiple companies involved in the development or commercialization of quantum computing technologies. Just like any other ETF, or exchange-traded fund, it is traded on stock exchanges and allows investors to buy into a collection of assets rather than just one stock.

The main advantage of investing in a quantum computing ETF is diversification. Since the sector is still relatively new and volatile, placing all your bets on one company can be risky. A quantum computing ETF mitigates this by spreading the risk across a wide range of firms some may be directly building quantum computers, while others might be supplying crucial hardware or developing algorithms specifically for quantum platforms.

Quantum computing ETFs also make it easier for regular investors to gain exposure to a highly technical field. You don’t need to have a PhD in physics or computer science to understand how to invest. Most ETFs are managed by professionals who analyze market trends, assess company performance, and keep the fund aligned with its objectives. This gives investors a chance to tap into the quantum revolution with some confidence.

Why Quantum Computing Matters More Than Ever

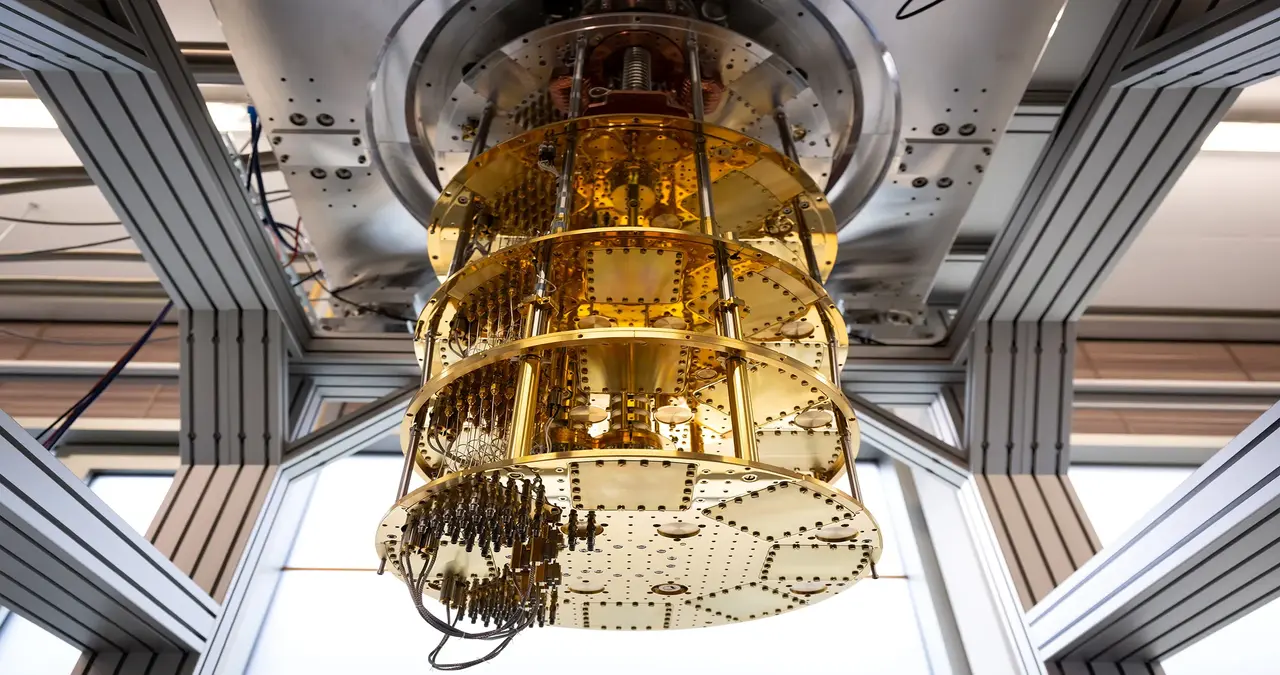

Quantum computing isn’t just another technological trend; it has the potential to rewrite the rules of what’s computationally possible. Traditional computers use bits to process data, which can be either a one or a zero. Quantum computers use quantum bits, or qubits, which can be both a one and a zero at the same time due to a property called superposition.

This capability allows quantum machines to process vast amounts of information more efficiently than classical computers. Problems that would take centuries to solve with today’s technology could be cracked in minutes using quantum methods. Think drug discovery, optimizing logistics, solving complex cryptography these are just a few real-world areas where quantum could play a transformative role.

The implications are massive. Financial institutions could run risk simulations at speeds previously impossible. Scientists could model molecular interactions for new medicine development. Governments could crack or protect encryption codes with quantum-level security. All of this paints a very bullish picture for companies working in this domain, making a quantum computing ETF an appealing investment opportunity.

Components of a Typical Quantum Computing ETF

When you dive into a quantum computing ETF, you’ll find it’s composed of various types of companies. Some of them are core quantum tech developers think firms creating quantum hardware, superconducting qubits, or photonic processors. Others are software companies developing quantum algorithms, platforms, and interfaces that allow programmers to tap into quantum systems.

Then, some companies are enabling the ecosystem semiconductor giants, cloud computing firms offering quantum-as-a-service platforms, and even cybersecurity companies preparing for the quantum age. The diversity of components in a quantum computing ETF means you’re not just betting on the future of one startup or enterprise, but on the broader adoption of quantum tech across sectors.

Many ETFs also include large tech companies like IBM, Google, Microsoft, and Amazon, which have already made substantial investments in quantum R&D. While these tech titans may not be pure-play quantum companies, their influence and resources make them important players in the ecosystem, and thus, they often hold significant weight in quantum computing ETF portfolios.

The Rising Appeal of Quantum Computing ETF Among Investors

One of the reasons why the quantum computing ETF is gaining traction is the increased awareness and interest in disruptive technologies. As people saw with the rise of electric vehicles, AI, and blockchain, those who invested early in emerging tech often saw significant returns. Quantum computing has that same disruptive potential, making it a target for long-term growth investors.

Moreover, institutions and retail investors alike are seeking alternatives to traditional sectors. With high volatility in the global markets, many are turning toward innovation-led ETFs to balance their portfolios. A quantum computing ETF fits perfectly into this mold it’s futuristic, backed by real science, and offers exposure to a sector poised for exponential growth.

Another key driver of interest is government backing. Several nations, including the United States, China, and those in the EU, are pouring billions into quantum research and infrastructure. These investments are trickling down to companies and startups included in many quantum computing ETF products, further strengthening their growth prospects.

Potential Risks of Investing in a Quantum Computing ETF

Like all investments, a quantum computing ETF is not without its risks. One of the biggest concerns is the immaturity of the market. Quantum technology is still in the research and development phase for most companies, meaning actual commercial applications are years maybe even decades away.

This long gestation period can lead to market fluctuations, failed projects, and a lack of short-term revenue generation for many of the companies within the ETF. Investors must be prepared for volatility and have a long-term horizon if they choose to invest in this space.

Another challenge is competition. As quantum computing heats up, more players are entering the game. This can dilute profits and lead to patent wars, regulatory scrutiny, or market fragmentation. Not every company in a quantum computing ETF will succeed. The goal of the ETF, though, is to minimize individual failure by casting a wider net, but it’s still essential to understand the inherent risk.

Comparing Quantum Computing ETFs with Other Tech ETFs

Quantum computing ETF is often compared to other thematic ETFs, such as those focused on artificial intelligence, robotics, or cybersecurity. While there is some overlap, quantum ETFs are unique because of their specificity and futuristic orientation. Unlike AI or cloud ETFs that invest in established businesses with current revenues, quantum ETFs are often composed of firms that are still in experimental stages.

This distinction is important because it shapes the risk-reward profile. AI and robotics ETFs tend to be more stable, with immediate use cases and proven business models. Quantum computing ETF, on the other hand, is like investing in the early days of the internet massive potential, but not without uncertainty.

Another unique factor is the kind of innovation quantum brings to the table. Many tech ETFs focus on enhancing what already exists, while quantum computing proposes an entirely new framework. This makes quantum computing ETF a more speculative but also potentially more rewarding investment.

How to Evaluate a Quantum Computing ETF Before Investing

Before jumping into a quantum computing ETF, it’s crucial to do your homework. Start by looking at the underlying assets. Are they mostly established companies, startups, or a mix? Are they directly involved in quantum tech, or are they peripheral players?

Also, check the expense ratio. Quantum ETFs tend to have slightly higher fees compared to traditional index funds because of the specialized management they require. Make sure that the potential return justifies the cost.

It’s also wise to look at the performance history, although this can be tricky since many quantum ETFs are relatively new. In that case, analyze the prospects of the companies they hold, read up on recent developments in the quantum field, and stay updated on any regulatory changes that might impact the sector.

Major Players Featured in Popular Quantum Computing ETFs

If you look at some of the leading quantum computing ETF offerings in the market, you’ll see a familiar list of tech heavyweights. Companies like IBM, Google’s parent Alphabet, Microsoft, and Amazon Web Services often cut because of their active quantum research labs and cloud-based quantum computing platforms.

Startups like Rigetti Computing, IonQ, and D-Wave are also commonly featured. These companies are at the forefront of building commercial-grade quantum processors and software. Although smaller and riskier, they represent the bleeding edge of innovation in the space.

Other players might include chip manufacturers like Nvidia and Intel, which are vital to quantum development. Even companies specializing in quantum sensors, photonics, and cryptography might be represented. This mix provides a solid foundation for a quantum computing ETF to thrive as the industry evolves.

The Long-Term Outlook for Quantum Computing ETF

The future of quantum computing ETF looks promising, albeit with some caveats. As the technology matures, we’re likely to see more companies going public, improved quantum algorithms, and perhaps even early commercial deployments in sectors like logistics or pharmaceuticals.

With more governments stepping up funding and tech giants racing to outpace each other, the quantum field is expected to grow steadily. This bodes well for any quantum computing ETF that is thoughtfully constructed and actively managed.

However, patience will be key. Investors looking for overnight success may be disappointed. The best strategy might be to treat a quantum computing ETF as a moonshot one that could yield significant returns over the long haul but requires resilience and foresight.

Final Thoughts on Investing in Quantum Computing ETF

Quantum computing ETF provides a unique window into the future of technology. It’s not just about buying stocks it’s about investing in a paradigm shift. For those willing to stomach the volatility and think long-term, this could be one of the most exciting areas to watch in the coming years.

Whether you’re a tech enthusiast, a curious investor, or someone seeking to diversify your portfolio with innovation-led opportunities, a quantum computing ETF could be a compelling choice. Just remember to approach it with the same diligence you would any investment do your research, understand the risks, and keep an eye on the ever-evolving landscape of quantum computing.