PayPal UK Business Account: A Complete Guide for Entrepreneurs

PayPal UK Business Account: When it comes to online business in the UK, having the right payment solution can make or break your operations. Among the leading platforms available, the PayPal UK business account stands out as a versatile, trusted, and widely recognized tool for companies big and small. Whether you’re just getting your startup off the ground or scaling your e-commerce brand, understanding how a PayPal UK business account works can be a huge asset.

This article will walk you through everything there is to know about the PayPal UK business account, from its features to how to set it up, manage it, and leverage it for growth. We’ll keep things friendly and casual, but rest assured you’re getting expert-level insights throughout.

What Is a PayPal UK Business Account?

A PayPal UK business account is a digital payment solution specifically tailored for businesses operating in the United Kingdom. Unlike a personal PayPal account, this one is built with features that help businesses send, receive, and manage payments more efficiently.

It’s designed to be flexible and scalable, meaning you can use it whether you’re running a solo venture, a small team, or a full-blown company. With a PayPal UK business account, you can accept payments in multiple currencies, invoice clients, link them to e-commerce platforms, and much more.

Why Choose PayPal UK for Your Business?

Choosing a PayPal UK business account gives you a huge advantage when it comes to gaining customer trust. Since PayPal is already a household name in the online payments world, customers are more likely to complete a purchase when they see the PayPal logo at checkout.

Aside from consumer trust, PayPal also provides robust fraud protection, seller protection, and streamlined bookkeeping tools. If you’re running a business online, having these features can save you a lot of time and headaches.

How to Set Up a PayPal UK Business Account

Setting up a PayPal UK business account is fairly straightforward. You’ll begin by visiting the PayPal UK website and selecting the business account option. From there, you’ll be asked to provide basic details like your business name, email, and type of business.

Once you’ve input your information, PayPal will prompt you to verify your identity and connect your bank account. The process is designed to be user-friendly, even for those who aren’t particularly tech-savvy. After verifying your account, you’ll gain access to all the features available to business users.

Features of a PayPal UK Business Account

One of the biggest perks of using a PayPal UK business account is its robust feature set. You can send professional invoices directly from your account, making it easy to get paid on time. Additionally, you can customize your invoices with your business logo and contact information.

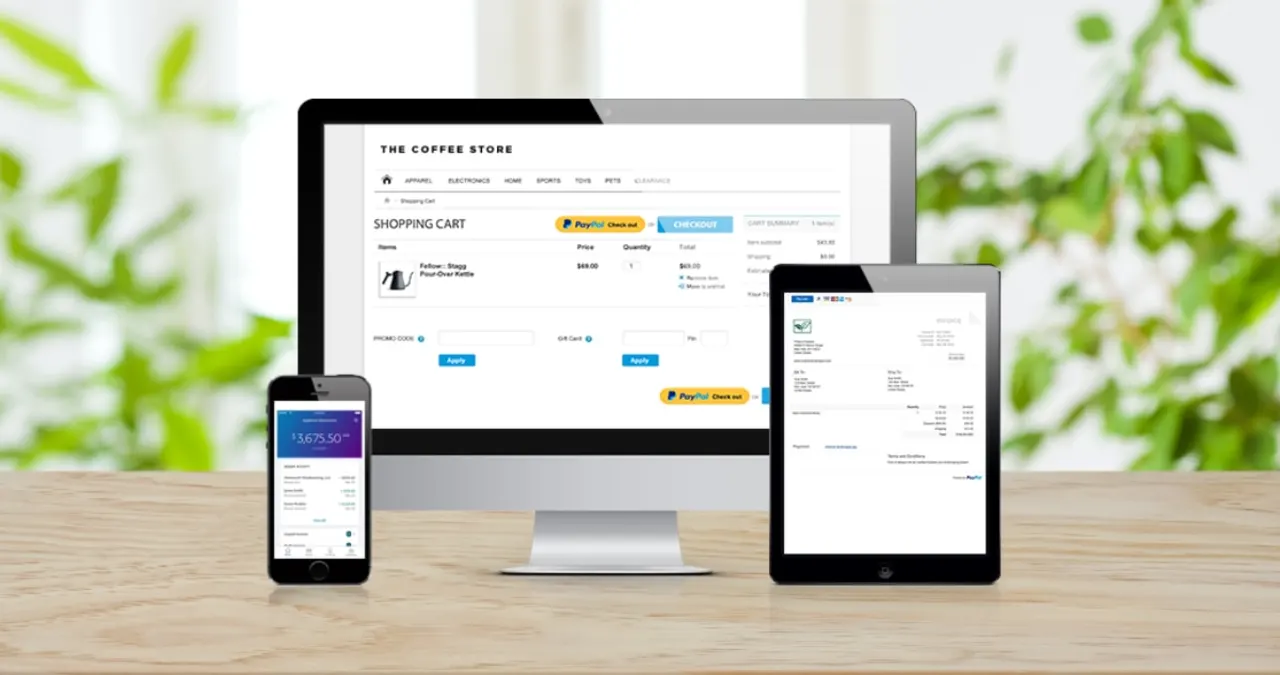

Another major benefit is the ability to accept multiple payment methods. From credit and debit cards to bank transfers and PayPal balance payments, you can cater to a wide range of customer preferences. Plus, the mobile-optimized checkout process ensures your customers can pay easily from any device.

PayPal UK Business Account Fees

While a PayPal UK business account offers many advantages, it’s important to understand the fee structure. PayPal typically charges a percentage of each transaction along with a small fixed fee. These fees can vary depending on factors like the buyer’s location and currency exchange rates.

That said, many businesses find the fees justifiable given the convenience, security, and credibility PayPal provides. Make sure to factor these costs into your pricing strategy so they don’t eat into your margins unexpectedly.

Linking Your PayPal UK Business Account to Other Platforms

Another strong point of the PayPal UK business account is its ability to integrate with various platforms. Whether you’re using Shopify, WooCommerce, BigCommerce, or even a custom-built website, adding PayPal as a payment method is usually as simple as copying and pasting a few API keys.

The platform also links seamlessly with accounting tools like QuickBooks and Xero, helping you keep your financial records accurate and up to date. This integration alone can save you hours of manual data entry.

Invoicing and Payment Requests Made Simple

PayPal makes it incredibly easy to send invoices and request payments. With just a few clicks, you can create and email an invoice that includes all the necessary details, from item descriptions to due dates. You can also add tax rates, shipping costs, and discounts directly within the invoice interface.

The best part? Your clients can pay instantly with their preferred method. This speed and convenience often lead to faster payments, which is a major win for cash flow management.

Currency Conversion and International Payments

A PayPal UK business account isn’t just limited to domestic transactions. You can also send and receive payments from international customers, making it a great option for global e-commerce businesses. PayPal supports multiple currencies and handles conversions automatically.

While there is a fee for currency conversion, it’s generally competitive with other international payment providers. This allows your business to expand globally without the need for complex banking arrangements.

Security and Fraud Protection for Businesses

Security is one of the top reasons businesses opt for a PayPal UK business account. The platform uses end-to-end encryption and AI-powered fraud detection systems to help keep your transactions secure. Plus, PayPal offers seller protection for eligible transactions, which can be a lifesaver in cases of chargebacks or disputes.

Knowing that your payment system is secure allows you to focus more on growing your business and less on dealing with potential fraud issues.

Managing Your Business Finances with PayPal

A PayPal UK business account also serves as a useful financial management tool. You can easily track income, view transaction history, and download reports for your accounting needs. The dashboard provides a clear overview of your cash flow, which can be essential for budgeting and financial planning.

Some businesses even use their PayPal account as a primary operating account, especially in the early stages, due to its convenience and accessibility.

Mobile App Features for On-the-Go Business Management

The PayPal Business mobile app brings all the core features of your account into your pocket. You can send invoices, accept payments, and even manage disputes while on the go. This is especially handy for freelancers and small business owners who may not be in front of a computer all day.

The app also includes tools for monitoring transactions and receiving real-time notifications. This kind of flexibility allows you to stay in control of your finances no matter where you are.

Customer Experience and Checkout Options

A smooth and trustworthy checkout experience can greatly improve customer satisfaction. With a PayPal UK business account, you can offer various checkout solutions, including one-click purchases, recurring billing, and even “buy now, pay later” options.

These choices not only cater to different customer preferences but can also increase your conversion rate. A simplified checkout reduces cart abandonment, helping you close more sales with less effort.

Customizing Your Business Profile and Branding

PayPal allows you to personalize your account by adding business logos, custom email templates, and more. This helps reinforce your brand image and provides a professional touch to your communications and invoices.

The ability to present a cohesive brand experience, even in your financial transactions, can give your business a polished and trustworthy appearance.

Handling Disputes and Refunds Professionally

No business wants to deal with disputes, but when they arise, it’s good to know you have a solid system in place. PayPal offers a Resolution Centre where you can manage claims, respond to buyer concerns, and issue refunds if necessary.

Having a structured way to handle these situations can improve customer relationships and maintain your business reputation.

Conclusion: Is a PayPal UK Business Account Right for You?

If you’re running a business in the UK and want a simple, effective way to handle online payments, a PayPal UK business account is a solid choice. It’s secure, widely trusted, and packed with features that cater to businesses of all sizes.

Whether you’re just starting or looking to streamline an existing operation, the flexibility and functionality offered by PayPal can be a significant asset. From easy setup to seamless integrations and strong security measures, it ticks all the boxes.

As with any financial tool, it’s essential to understand the associated costs and how it fits into your overall business strategy. But if you’re looking for a reliable, user-friendly platform that can scale with your business, a PayPal UK business account deserves serious consideration.